Six top European stocks

The search for the next great eurostars

Europe's economies may be growing slowly, but its markets are heading for a fourth year of double-digit increases. We found six promising stocks

British Petroleum

NYSE: BP

Price: $69

52-week low: $63

52-week high: $77

P/E ratio: 10

Yield: 3.5%

For Britain's BP, 2006 has been what Queen Elizabeth II once called an annus horribilis. From a pipeline leak that forced the company to close its Prudhoe Bay oilfield in Alaska in the summer to billions in legal claims stemming from a disaster at a Texas refinery, the past 12 months have been an exercise in what analysts call "headline risk." But while those problems have been a major headache for CEO John Browne and have revealed deep management failures at BP's North American unit, the long-term outlook remains solid. The company is still the second largest of Big Oil's super-majors in terms of production (only Exxon Mobil is bigger), with huge untapped reserves stretching from Russia to West Africa to the Gulf of Mexico.

For investors there's a silver lining to BP's stormy year. Despite bumper profits from record oil prices, BP shares have underperformed rivals such as Exxon, Chevron and Royal Dutch Shell, making the British giant an appealing value proposition. While Exxon is trading at 11.8 times next year's earnings, BP carries a multiple of only 9.8. "At the end of the day, BP has reasonable growth prospects and no longer trades at a premium," says Putnam's Byrne. Meanwhile, BP's multibillion- dollar stock-buyback plan and its 3.5% dividend offer further downside protection. Even if oil prices moderate, says Bear Stearns analyst Nicole Decker, "BP is among the rare few companies that will continue to grow organically at a reasonable cost." Plus, says Decker, 2007 should see a recovery in both the company's image and its financial performance as it puts Alaska, Texas and other trouble spots behind it. She thinks BP shares could hit $82 by the end of 2007, a 21% gain over the current $68.

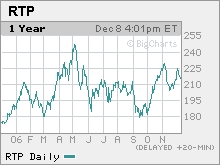

Rio Tinto

NYSE: RTP

Price: $214

52-week low: $171

52-week high: $253

P/E ratio: 11

Yield: 1.4%

Rising oil prices may have grabbed the spotlight in recent years, but they're only a small part of the global commodities boom. Metals have appreciated even faster. Copper has nearly tripled over the past year, as demand from China and other emerging markets has soared. Mining stocks have jumped as well, but few companies are better positioned to benefit than Britain's Rio Tinto. With huge operations in Australia (shares are listed in both London and Sydney), Africa and the Americas, Rio Tinto expects revenues this year to grow 25% compared with last year's, while profits should finish up more than 50%.

Copper and iron ore account for 75% of earnings, but the company also has valuable exposure to other hot metals, such as uranium. Even better, it has deep reserves, including an interest in four of the world's top ten undeveloped copper projects. Iron ore production is also growing rapidly, says J.P. Morgan analyst David George, which should help earnings even if copper prices cool off. And with a P/E ratio of ten and minimal debt, Rio Tinto is cheaper than such rivals as BHP Biliton, which trades at more than 12 times earnings. George sees a 30% upside in Rio Tinto shares, which have pulled back recently to $215 amid global fears of an economic slowdown.

Credit Suisse

NYSE: CS

Price: $68

52-week low: $50

52-week high: $69

P/E ratio: 12

Yield: 3.4%

Our next pick, Credit Suisse, is well known in the U.S. as a major player in investment banking, but back home in Switzerland, says Putnam's Byrne, it has long played second fiddle to UBS because of the latter's dominance in wealth management. Now that's changing: Credit Suisse sold its slow-growth insurance business, Winterthur, to AXA for $10 billion this summer and is focusing on its own wealth management business while boosting margins at its U.S. investment bank. The Zurich giant has also launched an aggressive stock-buyback program, with the goal of snapping up nearly $2 billion of its stock, or 3% of outstanding shares, by next April.

Like our energy-sector recommendations, Credit Suisse is also reasonably priced, trading at 10.9 times forward earnings, compared with P/E multiples of 12.6 for UBS and 11 to 12 times earnings for U.S. investment banks, according to Citigroup analyst Jeremy Sigee. In November, Sigee upped his rating on Credit Suisse from hold to buy, while increasing his target price to $75. With Credit Suisse currently trading at $67 - and boasting a 2.8% dividend - you're looking at a potential gain of nearly 15%. Not bad for a typically conservative Swiss bank.

Ba

nco Santander

NYSE: STD

Price: $18

52-week low: $13

52-week high: $19

P/E ratio: 12

Yield: 2.5%

While Credit Suisse has been refocusing on its core business, Spain's Banco Santander has been riding an expansion wave that has made it the biggest bank in the eurozone. Earlier this year it acquired Britain's Abbey National, boosting an international profile that also includes such rapidly growing Latin American markets as Brazil, Mexico and Chile. In addition, Santander is thriving because of the boom in its home market, where economic growth over the past ten years has averaged 3.6% annually, nearly twice the rate of other European countries. Morgan Stanley analyst Pablo Beldarrain Santos, who rates Santander his top pick among Spain's banks, expects earnings to jump 25% this year and 20% in 2007.

Despite that kind of earnings growth, Santander remains reasonably priced, trading at ten times projected 2007 earnings, a 10% discount to other banks in Europe. If all that weren't enough, Santander pays a 3% dividend, which analysts expect to rise as profits grow in the next few years. Santos sees an upside of 20% in the shares of this fast-growing bank, which are now trading at $18 for its U.S.-listed ADRs.

Veolia

NYSE: VE

Price: $67

52-week low: $43

52-week high: $68

P/E ratio: 29

Yield: 1.4%

Although Veolia has been in business in France for more than 150 years, its name may be unfamiliar even to investors who follow European business. Formerly the water-supply and environmental- services division of Vivendi, Veolia was split off and renamed in 2003. Since the split from the entertainment side of the business (which retains the Vivendi name), Veolia has thrived, nearly doubling over the past two years on strong growth in its utility business in France and around the world. In the U.S., for example, Veolia supplies drinking water in Indianapolis and wastewater treatment at Kentucky's Fort Knox. Earnings growth for 2006 is expected to top 30%, while revenues are rising at a 20% rate.

For long-term investors, the appeal of Veolia is that it's a great way to play the growing demand for a commodity that in many parts of the world is scarcer than oil - fresh drinking water. In India, China and other emerging markets, population growth and environmental pressures offer Veolia tremendous opportunities in areas like water treatment and desalinization. The company already provides water to nearly 19 million people in China and has also won new contracts recently in the Persian Gulf and in Yerevan, the capital of Armenia. Shares of Veolia have rallied since the summer, when management abandoned plans to merge with French construction company Vinci, but HSBC analyst Verity Mitchell still sees 20% upside in the stock, which currently trades at $66.

Royal Philips Electronics

NYSE: PHG

Price: $37

52-week low: $27

52-week high: $38

P/E ratio: 7

Yield: 1.2%

Our last pick, Royal Philips Electronics, is well known as a maker of consumer products like Norelco shavers, light bulbs (the British royal family recently asked Philips to light Buckingham Palace with its low-energy bulbs) and medical devices such as CT scanners. But on Wall Street, says Franklin's Brugere, analysts have tended to focus on the company's huge but low-margin semiconductor business.

Now in the midst of a turnaround, Philips agreed in August to sell 80% of the chip business to private-equity buyers for more than $10 billion, freeing up cash for higher-margin divisions such as medical devices, as well as an aggressive stock-buyback program. With this transaction, says Brugere, "volatility has been reduced, multiple expansion is taking place, and management is doing what it has promised in terms of restructuring." Wall Street has taken notice: Philips shares have rallied since the August deal, rising from $30 to more than $37, and the company has boosted its multiple to roughly 22 times 2007 earnings. Even so, says Brugere, there's still an upside of 20% as this Dutch giant cuts costs, drives shareholder returns, reallocates capital, and earns new respect from the Street.

Quelle: CNN.com