Quelle: Kelvin Wong - Chief Technical Strategist (Asia):

Kelvin is a professional technical analyst with extensive experience in stock indices, equities and foreign exchange. Kelvin employs a combination of fundamental and technical analysis and specialises in utilising Elliot Wave and Fibonacci analysis. He has also conducted technical analysis related seminars and training programmes for thousands of private traders in Singapore and Malaysia.

http://www.cityindex.com.sg/market-t...s/kelvin-wong/

https://www.cityindex.com.sg/market-...2-7c37ad1bb613

MARCH 27, 2018 5:15 PM: S&P 500 by Kelvin Wong

Quelle:

https://www.cityindex.com.sg/market-...o-30-mar-2018/

hier nur zusammengefasste Fassung, Volltext nur beim Link zur Quelle zu sehen!

Potential push up in progress towards “Symmetrical Triangle “range resistance

likely to continue its rebound from its “Symmetrical Triangle” range support which is this week’s key medium-term pivotal support at 2585.

In the short-term (1 to 3 days range), the Index faces the risk of a minor pull-back at the

2690 intermediate resistance (former minor swing low areas of 07/20 Mar 2018)

>2585: up to target the “Symmetrical Triangle” range resistance at 2740/50

before another round of potential choppy decline materialises within the range.

<2585: retest the 2540/30 major support zone

---------------------------------------

DB S&P 500 Indikation:

---------------------------------------

DB S&P 500 Indikation:

1

2

5

S&P 500 mit SMA Linie bei 350:

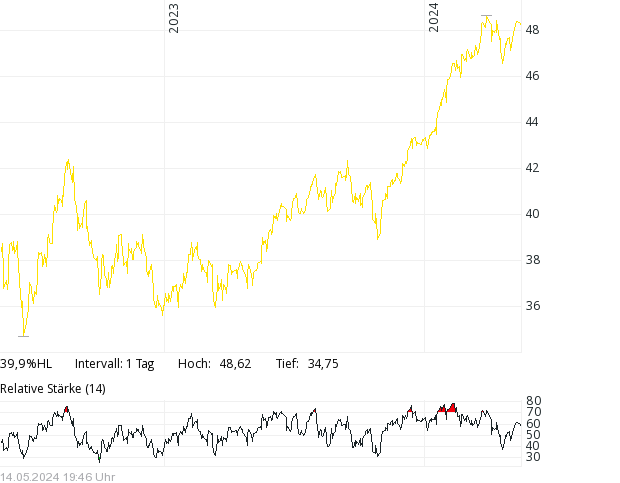

S&P 500-Zerti ISIN DE0007029803 ohne Hebel in €:

S&P 500-Zerti ISIN DE0007029803 ohne Hebel in €:

Nasdaq-100 Index

Nasdaq-100 Index

SPX

XLF - Financial Select Sector SPDR ETF

XLF - Financial Select Sector SPDR ETF

fini Wong SPX