Shorting Japanese Bonds: Betting Against The Italy Of Asia

by: Nicholas Pardini December 2, 2011

the same factors that have driven up the yields in sovereign debt in Europe are just as prevalent in Japan... Due to an oncoming demographic catastrophe, near zero percent yields, an overvalued currency, and unsustainable debt levels, I am extremely bearish on the prospects of Japanese government bonds.

...Unlike the US, nearly all of Japan's debt is financed by its own citizens. Unfortunately, Japan's wealth and savings is heavily concentrated among the older citizens of the country. Japan's largest generation is currently beginning to retire. As more of them leave the workforce, they will change from net savers to net consumers and sell their bond holdings (or not renew them upon maturity) to pay for living expenses.

...The younger generations in Japan are fewer in numbers than their parents and also much poorer ecomically. Estimates from Japanese government surveys indicate that the population of those who either live with their parents unemployed or bounce between low paying jobs range anywhere between 25% to 60% of Japanese youth. As a result, younger workers will not be able to buy enough Japanese debt to replace the older sellers.

Foreigners will not buy Japanese debts at such low yields (10-year currently 1.06%). With the world's highest debt-to-GDP ratio at 220%, any significant rise in yields would put the country at the risk of default. With debt servicing already amounting to 14% of the Japanese budget, a 200 basis point rise will make the Japanese government insolvent.

An indirect way to profit off a Japanese debt crisis is through shorting the Yen. Over the past five years, the Yen index (FXY) has appreciated by over 50%. The reason for this is not because the Yen is fundamentally strong, but that financial crises have triggered global central banks to lower their interest rates to match Japan's near-zero interest rate policy. Since the Yen had already priced in zero percent interest rates, the rest of world's currency's just fell.

The implosion of the Japanese bond market will be catastrophic for the Yen as investors will lose confidence in the currency and/or the Bank of Japan will resort to printing money to finance its budgetary shortfalls.

Japan has an aging population, with wealth concentrated among the elderly, smaller and poorer succeeding generations, an overly strong currency, and an unsustainable government debt/GDP level. Now is the time to enter a short position into Japanese debt, before these issues get priced in.

(Leicht gekürzt wiedergegeben)

Quelle:

http://seekingalpha.com/article/3115...ia?source=feed

Decmeber 2, 2011: Japanese Rating Agency Disturbs Myth of JGB Safety

http://seekingalpha.com/article/3115...ia?source=feed

JGB-Short-Zerti: http://www.ftor.de/tbb/showthread.ph...819#post164819

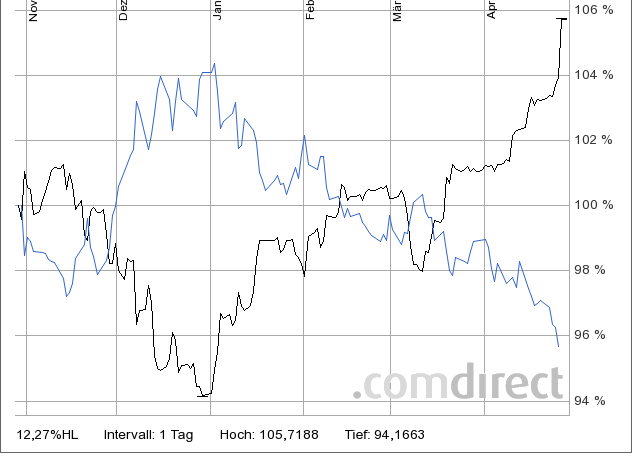

USD/JPY

JAPANESE GOVERNMENTS 7-10 YRS (TRR, EUR)