Oil futures rally 8% on possible OPEC output cut

By Polya Lesova, MarketWatch

Dec. 8, 2008

NEW YORK (MarketWatch) --

Oil futures surged 8% Monday, buoyed by

expectations that the OPEC oil cartel may deliver a substantial cut in production as well as U.S. President-elect Barack Obama's pledge of massive new infrastructure investment to revive the economy.

Crude oil for January delivery soared $3.18, or 8%, to $43.98 a barrel in electronic trading on Globex.

Earlier, the contract hit an intraday high of $44.35 a barrel.

The gains in oil prices were part of a broad-based rally in commodities.

The Reuters/Jefferies CRB Index (CRBreuters jefferies crb index, a benchmark gauging the prices of major commodities, soared 3.2% to 215.21 points.

Gold and other metals also soared.

The president of the Organization of Petroleum Exporting Countries, Chakib Khelil, told the Associated Press over the weekend that

a decision on production cuts will likely be made when OPEC meets on Dec. 17. Khelil said no decision on the output reduction has been made, but that it would be "severe."

In October, OPEC announced a production cut of 1.5 million barrels a day, while the cartel kept production unchanged at its November meeting.

A production cut of more than 1.5 million barrels a day would be necessary "to send a clear message to the market that OPEC is serious about supporting prices and so perhaps 2 million barrels per day is possible," said Michael Davies, an analyst at Sucden Research, in a note.

Last week, oil futures lost 25%, the biggest decline since the Persian Gulf War in 1991, amid heightened concerns over a slowdown in energy demand.

"Much of the recent drop in prices can be attributable to the unprecedented collapse in economic growth, but a good part of it could also be blamed on the [OPEC] cartel's surprising lack of urgency in confronting the magnitude of the price collapse and its reluctance to get in front of a deteriorating demand picture by cutting production more aggressively," said Edward Meir, an analyst at MF Global.

Dollar under pressure

In the currency markets, the U.S. dollar was under pressure Monday, boosting dollar-denominated commodities such as oil.

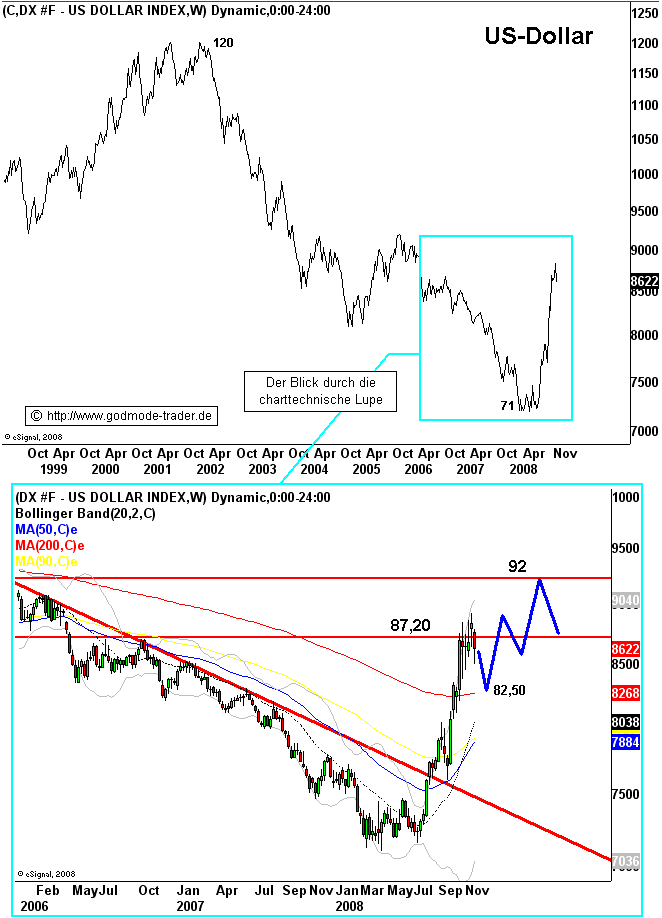

The dollar index (DXYUS Dollar Index Future - Spot Price

, which tracks the performance of the dollar against a trade-weighted basket of six major currencies, traded at 85.96, down from 87.14 in North American activity late Friday.

"Correlation is still the play," said Zachary Oxman, a senior trader at Wisdom Financial.

"Strong stocks, strong metals. Weak dollar, strong crude. This is the play and will remain so for some time I believe."

On Wall Street, U.S. stocks posted strong gains after lawmakers reportedly agreed on the outline of a deal to rescue the auto industry and President-elect Barack Obama pledged massive new infrastructure investment.

Over the weekend, Obama said he wants to create millions of jobs by "making the single largest new investment in our national infrastructure since the creation of the federal highway system in the 1950s."

Obama said he's asked his economic team to develop a recovery plan that will "help save or

create at least 2.5 million jobs , while rebuilding our infrastructure, improving our schools, reducing our dependence on oil, and saving billions of dollars."

Also on the Globex Monday, January reformulated gasoline rose 8 cents, or 9%, to 98 cents a gallon and January heating oil gained 8 cents, or 6%, to $1.51 a gallon.

January natural gas futures, however, fell 9 cents, or 2%, to $5.65 per million British thermal units.

Polya Lesova is a New York-based reporter for MarketWatch.