[IMG]The yield curve first inverted in March. This is nothing to ignore.[/IMG]

June 23, 2019 by Seth Levine -

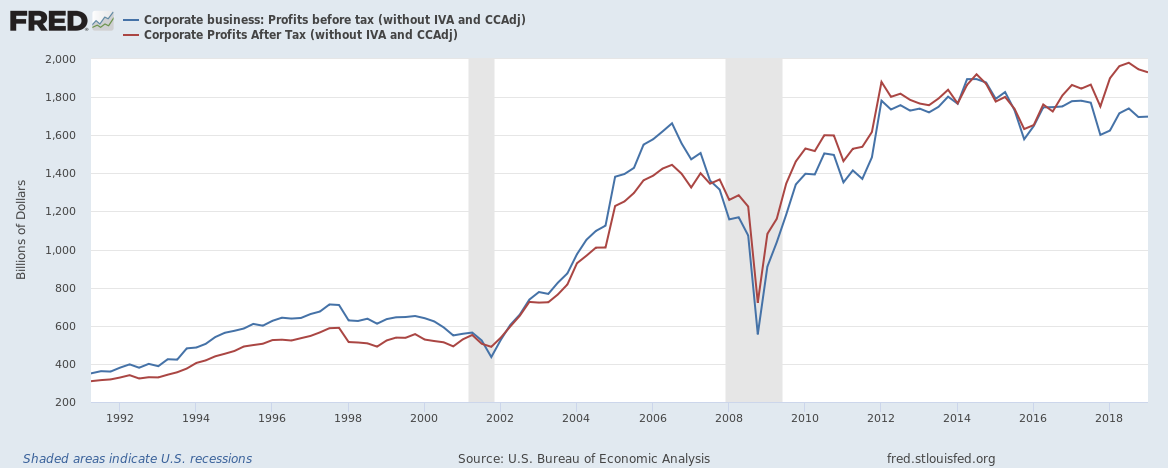

https://integratinginvestor.com/wp-c...edgraph-13.png

-------------------------------

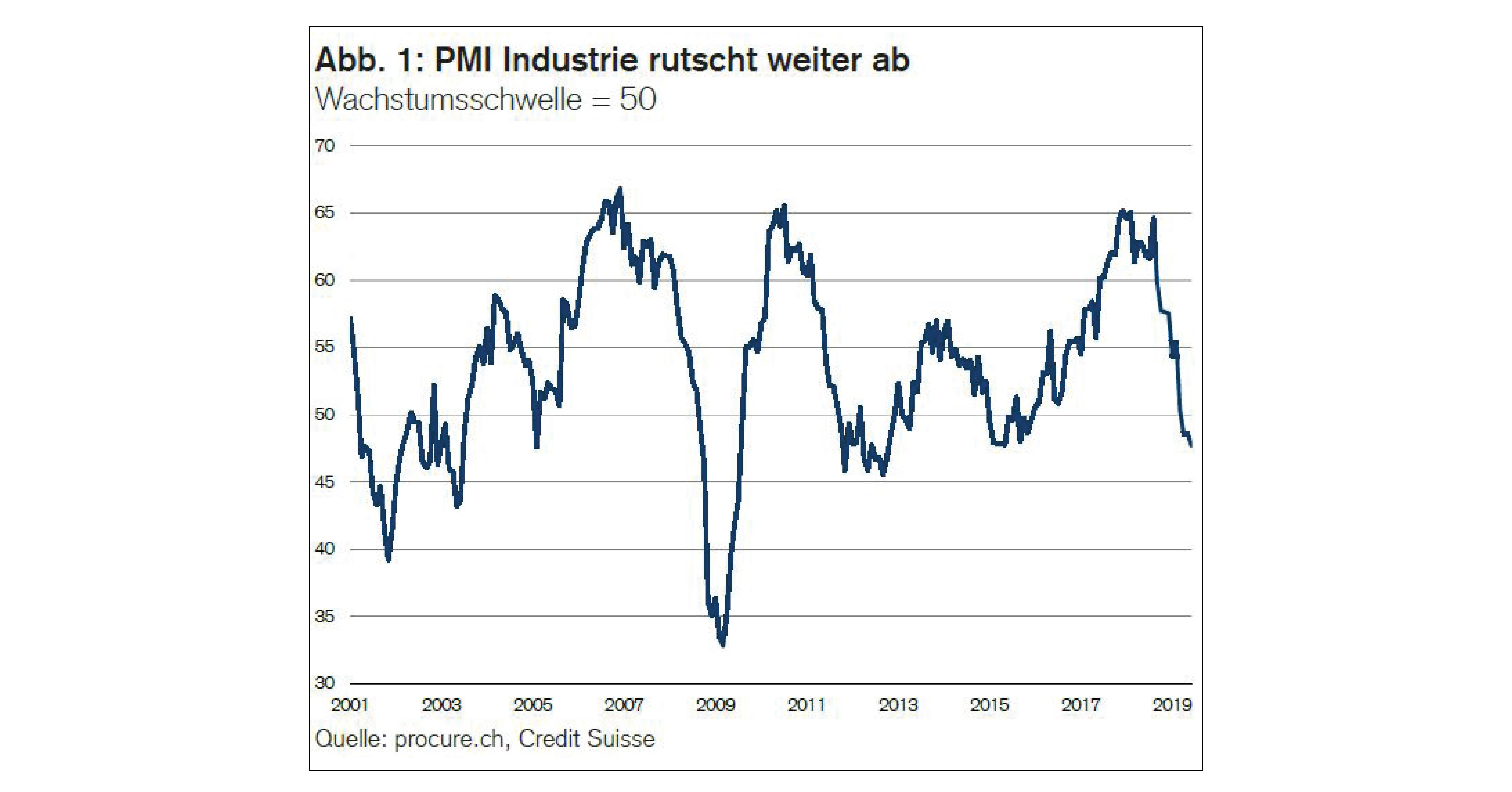

Quelle: PMI Juni 2019: Weitere Wachstumsverlangsamung

Publiziert am 01.07.2019, Autoren: procure.ch, Credit Suisse

https://www.procure.ch/magazin/artik...verlangsamung/

-------------------------------

https://integratinginvestor.com/wp-c...2-1024x412.png

--------------------------------------

https://integratinginvestor.com/wp-c...2-1024x412.png

--------------------------------------

Zitat:

Key Metrics

Earnings Scorecard: For Q2 2019 (with 16% of the companies in the S&P 500 reporting actual results), 79% of S&P 500

companies have reported a positive EPS surprise and 62% of companies have reported a positive revenue surprise.

Earnings Growth: For Q2 2019, the blended earnings decline for the S&P 500 is -1.9%. If -1.9% is the actual decline for the

quarter, it will mark the first time the index has reported two straight quarters of year-over-year declines in earnings since Q1

2016 and Q2 2016.

Earnings Revisions: On June 30, the estimated earnings decline for Q2 2019 was -2.7%. Six sectors have higher growth

rates today (compared to June 30) due to positive EPS surprises.

Earnings Guidance: For Q3 2019, 6 S&P 500 companies have issued negative EPS guidance and 5 S&P 500 companies

have issued positive EPS guidance.

Valuation: The forward 12-month P/E ratio for the S&P 500 is 17.0. This P/E ratio is above the 5-year average (16.5) and

above the 10-year average (14.8).

|

Quelle: John Butters, Senior Earnings Analyst,

jbutters@factset.com

July 19, 2019

https://www.factset.com/hubfs/Resour...ght_071919.pdf