|

|

|

#1 |

|

TBB Family

Registriert seit: Mar 2004

Beiträge: 10.373

|

Kollaps - und die Zeit danach (Bruchstücke-Sammlung)

Societal collapse: http://en.wikipedia.org/wiki/Societal_collapse

The Evolution of Complexity in Human Societies: http://baobab2050.org/2010/09/13/the...man-societies/ Peak oil: http://en.wikipedia.org/wiki/Peak_oil Als Buch:  The Collapse of Complex Societies: http://www.amazon.de/Collapse-Comple...6117407&sr=1-1 Eingescanned von Google: http://books.google.de/books?id=YdW5...page&q&f=false Als ppt-Vortrag: Collapse of Complex Societies by Dr. Joseph Tainter (1 of 7): http://peakoilupdate.blogspot.com/20...f-complex.html http://www.youtube.com/watch?v=ddmQhIiVM48&feature COMPLEXITY, PROBLEM SOLVING, AND SUSTAINABLE SOCIETIES http://dieoff.org/page134.htm Ähnlich und gut hier: http://upi-yptk.ac.id/Ekonomi/Tainter_Social.pdf Joseph A Tainter. Population and Environment. New York: Sep 2000.Vol.22, Iss. 1; pg. 3 http://songlight-for-dawn.blogspot.c...-collapse.html Essay: Social complexity and sustainability Joseph A. Tainter http://www.scribd.com/doc/31144234/J...Sustainability Joseph Tainter, for instance, has provided a detailed analysis of how the western and eastern Roman empires responded very differently to similar EROI crises. In the case of Byzantium, Tainter argues, the empire’s leaders undertook a very deliberate process of institutional reform and simplification (of everything from political administration to military structure) that brought energy demands into closer alignment with energy supply. Tainter claims that this shift explains the eastern empire’s extraordinary longevity. He also suggests that the process Byzantium went through has been extremely rare historically; most civilizations don’t have the foresight, competence, and political capacity to undertake such a change. ------------------------ An illuminating collapse was that of the Western Roman Empire in the Fifth century A.D. The Romans found conquest highly profitable at first, as they seized the accumulated wealth of the Mediterranean lands. But for a one-time infusion of wealth, Rome took on responsibilities to administer and defend the empire. These responsibilities lasted centuries, and had to be paid from yearly agricultural production. When there were extraordinary expenses, usually during wars, the government often found itself short of money. The usual strategy was to stretch the currency by adding copper. This was inflationary, and by the middle of the Third century A.D., the empire was bankrupt. The government would not even accept its own coins for payment of taxes. In the half century from 235 to 284, the empire nearly came to an end. There were foreign and civil wars, almost without interruption. Cities were sacked and provinces devastated. In the late Third and early Fourth centuries A.D., the emperors Diocletian and Constantine responded by designing a government that was larger, more complex, more highly organized, and much more costly. They doubled the size of the army at great expense. To pay for this, peasants were taxed so heavily that they abandoned lands and could not replenish the population. In the late Fourth century, the Barbarians forced their way into the Western empire. They overthrew the last Emperor in Italy in 476 A.D. I call this 'the Roman model' of problem solving. The Romans responded to challenges by increasing the size and complexity of their government and army, at great expense. Fiscal weakness, and exploitation of the population undermined the effort, and made collapse inevitable. The Eastern Roman Empire survived the Fifth century crisis. We know it today as the Byzantine Empire. It was constantly at war, and in the early Seventh century, a twenty six year war with Persia left both sides exhausted. Arab armies seized the wealthiest parts of the Byzantine realm, and destroyed the Persian Empire entirely. Soon the Arabs were attacking Constantinople itself, the Byzantine capital. Yet the Byzantines made a remarkable recovery.

[end quote from Professor Joseph Tainter, University of Utah.] Ähnlich auch in diesem Video auf eine Zuhörerfrage: http://www.youtube.com/watch?v=ub1DY-VRh4A&NR=1 Hier im Kapitel "The early Byzantine recovery": http://upi-yptk.ac.id/Ekonomi/Tainter_Social.pdf systematic simplification. Around 659 military pay was cut in half again. The government had lost so much revenue that even at onefourth the previous rate it could not pay its troops. The solution was for the army to support itself. Soldiers were given grants of land on condition of hereditary military service. The Byzantine fiscal administration was correspondingly simplified.The transformation ramified throughout Byzantine society. Both central and provincial government were simplified, and the costs of government were reduced.

Dark Age. The simplification rejuvenated Byzantium. The peasantsoldiers became producers rather than consumers of the empire’s wealth. By lowering the cost of military defense the Byzantines secured a better return on their most important investment. Fighting as they were for their own lands and families, soldiers performed better. During the eighth century the empire re-established control of Greece and the southern Balkans. In the tenth century the Byzantines reconquered parts of coastal Syria. Overall after 840 the size of the empire was nearly doubled. The process culminated in the early eleventh century, when Basil II conquered the Bulgars and extended the empire’s boundaries again to the Danube. The Byzantines went from near disintegration to being the premier power in Europe and the Near East, an accomplishment won by decreasing the complexity and costliness of problem solving (Treadgold, 1988, 1995, 1997; Haldon, 1990; Harl, 1996). ------------------------------------------ Der Kollaps: In the century before the victory of 718 the political and economic life of the eastern Mediterranean had been utterly transformed. The huge empire that the Romans had assembled was almost gone. Debasements and inflation had ruined monetary standards and the fiscal and economic institutions which depended on them. There were no longer standard weights to copper coins and monetary exchange was undermined. Around 659 Constans cut military pay in half again. With army pay by the 660s cut to one-fourth its level of 615, the government no longer pumped coins into the economy. By 700 most people within or formerly within the empire no longer used coins in everyday transactions. In most Mediterranean lands the economy ceased to have a monetary basis. The economy developed into its medieval form, organized around self-sufficient manors (Harl, 1996). One can scarcely imagine the magnitude of the transformation required to save what was left of Byzantium. A way of life to which the peoples of the eastern Mediterranean had been accustomed for over a millennium had to be given up. Der alte Weg ging nicht mehr, man mußte einen anderen weg gehen - oder untergehen: the emperors of the late third and early fourth centuries had responded to a similar crisis by complexification. They increased the complexity of administration, the regimentation of the population, and the size of the army. This was paid for by levels of taxation so harmful that lands were abandoned and peasants could not replenish the population. Constans II and his successors could hardly impose more of the same exploitation on the depleted population of the shrunken empire. Instead they adopted a strategy that is truly rare in the history of complex societies: simplification. Der Weg der Vereinfachung:

The system of themes rejuvenated Byzantium. A class of peasant-soldiers was formed across the empire. The new farmer-soldiers had obligations to no landowners, only to the state. They became producers rather than consumers of the empire's wealth. They formed a new type of army in which military obligation, and the lands that went with it, were passed to the eldest son. From this new class of farmers came the force that sustained the empire. By lowering the cost of military defense the Byzantines secured a better return on their most important investment. Die folgenden Probleme kommen bereits seit einigen Jahren gleichzeitig auf uns zu und werden sich alle gleichzeitig innerhalb der kommenden Jahre verstärken: (inexorable: unerbittlich, unaufhaltsam, kompromisslos, erbarmungslos, nicht aufzuhalten)

__________________

Beste Grüße, Benjamin

Geändert von Benjamin (14-02-2016 um 21:33 Uhr) |

|

|

|

|

|

#2 |

|

TBB Family

Registriert seit: Mar 2004

Beiträge: 10.373

|

Beyond Collapse: Archaeological Perspectives on Resilience, Revitalization, and Transformation in Complex Societies

46€, https://www.amazon.de/Beyond-Collaps...intl-de&sr=1-1 http://felixzulauf.com/media/ 22.01.2016: Zulauf: «Nun muss man in die Stärke verkaufen» http://www.fuw.ch/article/zulauf-nun...rke-verkaufen/  After Collapse: The Regeneration of Complex Societies [Taschenbuch] Glenn M. Schwartz (Herausgeber), John J. Nichols (Herausgeber) Taschenbuch: 336 Seiten From the Euphrates Valley to the southern Peruvian Andes, early complex societies have risen and fallen, but in some cases they have also been reborn. Prior archaeological investigation of these societies has focused primarily on emergence and collapse. This is the first book-length work to examine the question of how and why early complex urban societies have reappeared after periods of decentralization and collapse. Ranging widely across the Near East, the Aegean, East Asia, Mesoamerica, and the Andes, these cross-cultural studies expand our understanding of social evolution by examining how societies were transformed during the period of radical change now termed “collapse.” They seek to discover how societal complexity reemerged, how second-generation states formed, and how these re-emergent states resembled or differed from the complex societies that preceded them. The contributors draw on material culture as well as textual and ethnohistoric data to consider such factors as preexistent institutions, structures, and ideologies that are influential in regeneration; economic and political resilience; the role of social mobility, marginal groups, and peripheries; and ethnic change. In addition to presenting a number of theoretical viewpoints, the contributors also propose reasons why regeneration sometimes does not occur after collapse. A concluding contribution by Norman Yoffee provides a critical exegesis of “collapse” and highlights important patterns found in the case histories related to peripheral regions and secondary elites, and to the ideology of statecraft. After Collapse blazes new research trails in both archaeology and the study of social change, demonstrating that the archaeological record often offers more clues to the “dark ages” that precede regeneration than do text-based studies. It opens up a new window on the past by shifting the focus away from the rise and fall of ancient civilizations to their often more telling fall and rise. http://www.amazon.de/After-Collapse-...6122274&sr=1-1 Einzelkämpfer: Jay Hanson's Homepage: http://dieoff.org/dieoffindex.html Paul Chefurka: http://www.paulchefurka.ca/ Linklisten: von extern: http://www.beyondpeak.com/societies-...-collapse.html Von mir: https://www.ftor.de/tbb/showthread.ph...ter#post360995 https://www.ftor.de/tbb/showthread.ph...ter#post329510 Timing-Überlegungen zur Zukunft von mir: https://www.ftor.de/tbb/showthread.ph...light=Peak+Oil Von mir: Anteil Energiekosten am BIP https://www.ftor.de/tbb/showthread.ph...t=energy+spent Auf in die Post-Kollaps-Gesellschaft Egal, was wir tun – der Weg in eine nachhaltige Welt wird durch ein Tal der Tränen führen. Statt unsere Kräfte im Versuch zu vergeuden, den Kollaps aufhalten zu wollen, sollten wir uns mit aller Kraft auf die Welt vorbereiten, in der wir dann leben werden. http://www.oya-online.de/media/downl...s-Heimrath.pdf http://www.oya-online.de/article/rea...ellschaft.html Eine im August 2010 veröffentlichte Studie der Bundeswehr: "Peak Oil - Sicherheitspolitische Implikationen knapper Ressourcen" http://www.utopia.de/uploads/assets/...Ressourcen.pdf Decentralization: http://en.wikipedia.org/wiki/Decentralization Local government, Decentralisation http://www.communities.gov.uk/localg...entralisation/ Sozial ist, wer jetzt aussteigt! Der Sozialstaat muss radikal neu anfangen. Mit Hilfe der Komplexitätsforschung – ein Essay von Ulrike Fokken ChangeX – das unabhängige Online-Magazin für Wandel in Wirtschaft und Gesellschaft, 1. Juni 2005 http://antworten-aus-der-natur.de/texte/text-nr-1/  http://www.amazon.com/gp/product/159...cm_cr_asin_lnk  http://www.amazon.com/End-Growth-Ada...pr_product_top  http://www.amazon.com/Long-Descent-U...ref=pd_sim_b19  http://www.amazon.de/Schlachtfeld-Er...pr_product_top  http://www.amazon.de/Ausgebrannt-Thr...ref=pd_sim_b25  http://www.amazon.de/Sustainability-...6182548&sr=1-4  http://www.amazon.de/The-Long-Emerge...pr_product_top Video: History Channel, After Armageddon, Teile 1-9 http://www.youtube.com/watch?v=8r97xoSOEjM Tipping Point Near-Term Systemic Implications of a Peak in Global Oil Production An Outline Review 56 Seiten http://www.feasta.org/documents/risk...ping_Point.pdf EROEI bzw. EREI: http://en.wikipedia.org/wiki/EROEI (deutsch) http://en.wikipedia.org/wiki/Energy_...nergy_invested (englisch)  83 Seiten http://www.postcarbon.org/report/443...-for-a-miracle http://www.postcarbon.org/new-site-f...web10nov09.pdf EROI bzw. EROEI wird uns einen schnelleren Kollaps bzw. Absturz bringen, als es die üblichen symetrischen Hubbert-Kurven andeuteten. The Net Hubbert Curve: What Does It Mean? http://netenergy.theoildrum.com/node/5500 Declining EROI means that the amount of discretionary energy available to society is FAR less than that predicted by a Hubbert curve (Figure 2). The Hubbert curve represents the total gross quantity of energy available, and, as it is calculated, there are equal quantities of energy available on the left and right side of the peak. This, however, is only true in a gross sense. The net energy available (i.e. discretionary energy) is less. In other words, declining EROI means that there will be much less net energy extracted post-peak than pre-peak on the Hubbert curve. To understand this in greater depth, I quantified this relationship by first creating a replicate of the Hubbert curve published in 1971. I then applied the three point values of EROI over the past century (i.e. 1930 = 100:1, 1970 = 30:1, and 2000=11:1), and interpolated linearly the values between the points and into the future to a minimum EROI of 1.1:1. I have no a priori reason to believe that EROI has declined linearly or that it will decline to 1.1 and then level off, but it has certainly declined in the past and as long as it is declining the general results reported here are valid. I then used the following equation to calculate the percent of net energy available from the gross energy produced: (Siehe Chart unten) Für eine Analogie in die Wirtschaft ist dieses Posting wichtig: https://www.traderboersenboard.de/sho...8&postcount=68 Geändert von Benjamin (16-05-2016 um 16:45 Uhr) |

|

|

|

|

|

#3 |

|

TBB Family

Registriert seit: Mar 2004

Beiträge: 10.373

|

Das Folgende ist ein Zitat aus der u.g. Quelle:

David: Today we have debt and derivatives, financial products that add layers of complexity to bank finance, to household finance, and frankly, to systemic stability. These two elements of debt and derivatives have never been more system-critical, nor frankly, less understood, except by a select few specialists. Are these the kinds of complexities you might expect to contribute to collapse, or is bureaucracy, is liability mismanagement – are those the types that concern you most and that you are addressing, really? Dr. Tainter: The new kinds of financial products, derivatives and so forth, certainly make us vulnerable to loss of confidence in investments and so forth. Whether those can cause a collapse depends on, and I’ll go back to this phrase that I used before, our reserve problem-solving capacity. Now, when the 2008 financial crisis hit, we were able to counteract the financial downturn through heavy government spending which was financed very largely by borrowing, but we have borrowed so much money to meet that crisis, and we are continuing to borrow at very high rates to finance yearly deficits, that you have to ask, if a similar crisis came along next year, would we have the credit to be able to borrow again to counteract it? Or if a similar crisis came ten years from now, and if we were to continue government borrowing at the rate at which we are, would we be able to summon the fiscal resources to counteract it? This is the sort of thing that I think makes us vulnerable to a collapse, not having some reserve capacity to solve problems. Again, also, this is something that I think I see in ancient societies. And this is what we need to be, I think, very concerned about, and we have to have a long-term perspective on how our society and our economy evolved and what kinds of problems we are likely to face in the future. But the politicians, the political leaders who guide the country generally do not have a long-term perspective. They tend to be concerned, primarily, about the next election. So we don’t prepare for the future. Basically, we lurch from crisis to crisis, trying to solve each as if there were something to isolate it, when in fact, all of these crises are interdependent and as we solve one, that simply sets the stage for the next one down the road. David: This idea of reserve problem-solving capacity is absolutely perfect. You mentioned, in the context of Rome, that when the treasury was full, bad things could happen and you could absorb them, you could take them in stride, because you had the resources necessary to do so, and the real vulnerability came when the treasury was empty and the only course was the desperate course, whether it was inflation of the currency, or what have you. They didn’t do so much debt financing as we do today. In fact, today, we have a financial economy which is dependent on this sort of growth in debt. Bill Gross, just a few weeks ago, suggested that if our economy does not see an increase in debt by 2½ trillion dollars per year, that we can’t sustain our growth rates. That sounds kinds of backward, that debt is the source of growth in the economy, but it implies that consumers and businesses and governments have the capacity to continue to take on these liabilities. Maybe to the man in the street that sounds a bit ponzi-esque and we hope that the letter that just went out the door is not the last letter, as in a letter scheme. I guess that reserve problem-solving capacity is exactly what you got at, in terms of having a healthy treasury for Rome. And of course, there are other ways to solve the problem than spending money. Another author, Albert Hirschman, wrote a book many years ago called Exit, Voice and Loyalty, and he considers the breakdown of organizations, both companies and societies, and he lists exit as one possible choice. Exit, as you describe it in your book, is an economic choice. “Not going to participate.” In today’s complex society, that seems nearly impossible. We have coercion, which is made easier by the control of transportation, money flow, and information flows. As you discussed earlier, we now have new complexity in terms of Transportation Safety Administration, Homeland Security, etc. It would seem that complexity has today reached a level where exit is not possible. What are your thoughts? Dr. Tainter: You are absolutely right. We are trapped. We cannot simplify. We cannot withdraw from the way our system has evolved and the way we have set it up. We are at the point where we really are trapped in, I have to say, a downward spiral that we can’t get out of, or we will someday get out of it when a crisis occurs, but we can’t voluntarily withdraw from it because that would create too many other problems and politicians aren’t willing to create those kinds of problems. Zitat aus dieser Quelle: October 1, 2014, http://mcalvanyweeklycommentary.com/...lex-societies/ |

|

|

|

|

|

#4 | ||

|

TBB Family

Registriert seit: Mar 2004

Beiträge: 10.373

|

Freitag, 27.10.2017

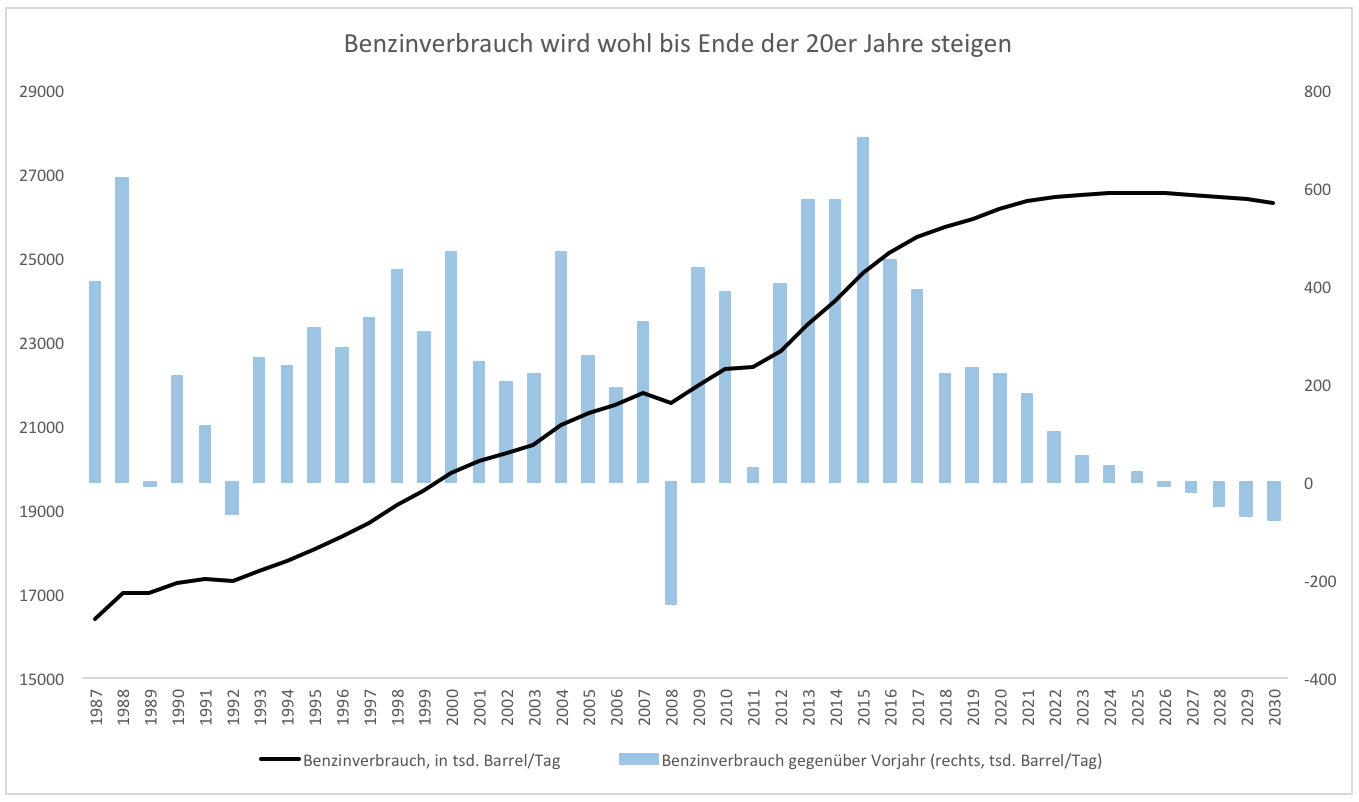

Elektroauto-Boom: Muss die Ölindustrie Angst haben? von Clemens Schmale, Finanzmarktanalyst, https://www.godmode-trader.de/artike...-haben,5581584  Zitat:

Zitat:

Geändert von Benjamin (29-10-2017 um 12:29 Uhr) |

||

|

|

|

|

|

#5 | ||

|

TBB Family

Registriert seit: Mar 2004

Beiträge: 10.373

|

...a revolution is coming

Last Updated: Oct. 31, 2020 at 8:15 a.m. ET First Published: Oct. 28, 2020 at 11:54 a.m. ET By Shawn Langlois, https://www.marketwatch.com/story/tr...click#cxrecs_s Zitat:

Zitat:

Unabhängig davon fand ich diese Quelle 21st Century, Timeline Revolutions of 2027 https://second-renaissance.fandom.co...utions_of_2027 Dort wird über solche Revolutionen in 2027 spekuliert. Die Quelle stammt von einem ...American engineer and writer Sean McKnight (YNot1989). He began creating this series in 2007 and reworked it over the course of years to its current form. https://second-renaissance.fandom.co...aissance_Wikia ++++++++++++++++++++++++++++++++++++++++++ Unabhängig davon hier meine grobe, überschlägige Peilung zum S&P 500 (in US-$), mit einem "interessanten Zeitbereich im Oktober 2027, weil dann die 423%-Extension auf den oberen Trendkanal-Linie trifft (bei einem S&P 500-Indesxtand von 4420. Aktueller S&P 500-Indesxtand: 3270, also von jetzt noch ca. 26% Wachstum bis zum Top). Das korreliert erstaunlich gut mit der oben zitierten Peilung von Mr. "“Bond King” billionaire and DoubleLine Capital boss Jeffrey Gundlach": "he expects widening economic inequality to bring about some sort of revolution by 2027" (wegen zunehmender ökonomischer Ungleichheit in der US-Bevölkerung, in der nur die bereits Reichen vom "Wachstum" profitieren) siehe hier: Bei den Fibo-Zeitproportionen habe ich die 0 logischerweise auf as Low im März 2009 gelegt, die 100% auf den Januar 2018, weil da das wellentechnische Top ereicht wurde; danach wurde im Febr. nur eine "b" gemacht, die folgende "c" war dann der bekannte Crash zum Low März 2020. Die 200%-Zeitextension davon ist ca. der 14.12.2026. Etwa am 27.09.2027 ist dann bei ca. 4420 Indexpunkten die Kreuzung von 423%-Extension mit der oberen Trendkanallinie - dort sollte das "historische Top" sein. Geändert von Benjamin (01-11-2020 um 17:49 Uhr) |

||

|

|

|

|

|

#6 |

|

TBB Family

Registriert seit: Mar 2004

Beiträge: 10.373

|

Is the United States on the brink of a revolution?

September 25, 2019 11.14pm BST https://theconversation.com/is-the-u...olution-123244 How to Start a Revolution: Young People and the Future of Politics (Englisch) Taschenbuch – 1. Oktober 2020 von Lauren Duca (Autor) https://www.amazon.de/How-Start-Revo...s=books&sr=1-3 Geändert von Benjamin (01-11-2020 um 19:32 Uhr) |

|

|

|

|

| Lesezeichen |

|

|

Es ist jetzt 00:39 Uhr.