24-03-2021, 10:03

24-03-2021, 10:03

|

#1

|

|

TBB Family

Registriert seit: Mar 2004

Beiträge: 10.373

|

Lynas Corp.

Lynas Corp.

WKN: 871899 ISIN: AU000000LYC6

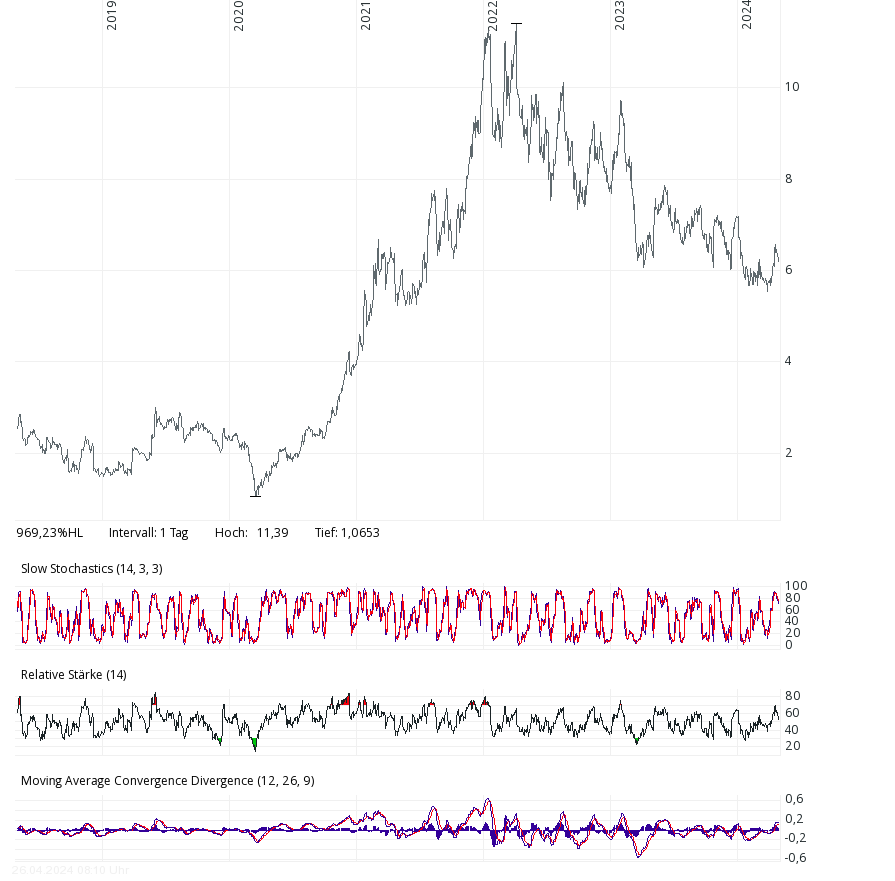

Börse Australien, also in AUD:

Linear:

6y

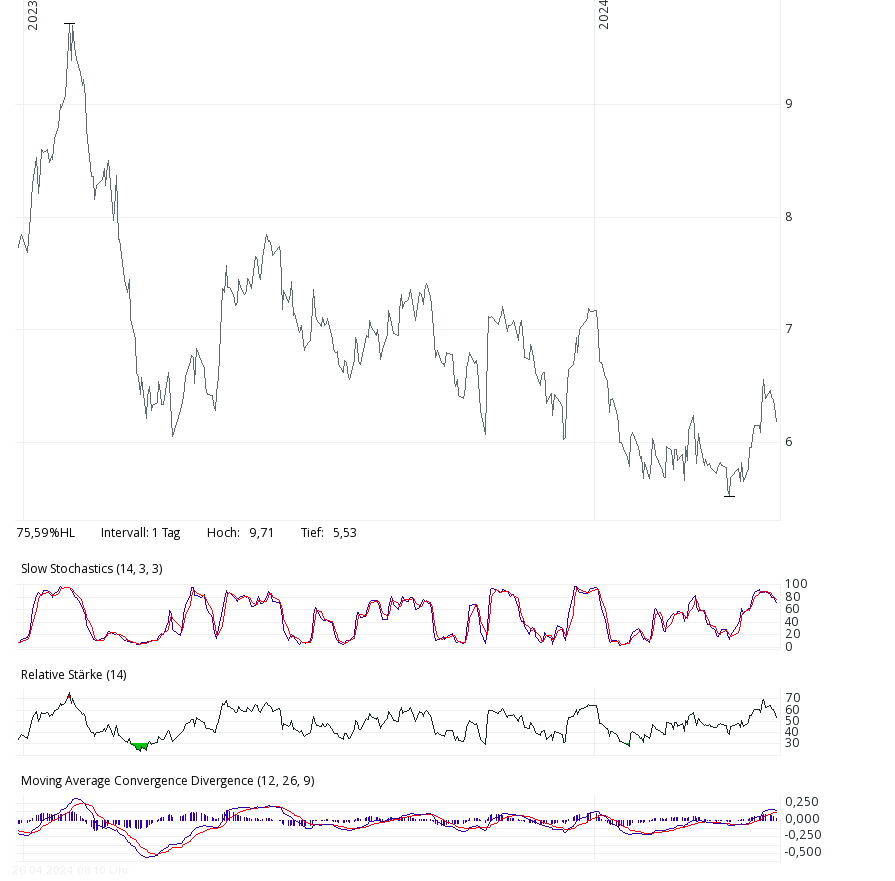

16m:

1m:

Geändert von Benjamin (24-03-2021 um 10:22 Uhr)

|

|

|

24-03-2021, 10:06

24-03-2021, 10:06

|

#2

|

|

TBB Family

Registriert seit: Mar 2004

Beiträge: 10.373

|

Geändert von Benjamin (24-03-2021 um 11:38 Uhr)

|

|

|

24-03-2021, 10:35

24-03-2021, 10:35

|

#3

|

|

TBB Family

Registriert seit: Mar 2004

Beiträge: 10.373

|

Why Lynas, Oil Search, Pushpay, & Webjet shares are tumbling lower

James Mickleboro | March 24, 2021 3:07pm

Zitat:

Lynas Rare Earths Ltd (ASX: LYC)

The Lynas share price is down 9% to $5.64. This is despite there being no news out of the rare earth producer today.

However, this morning, one of its rivals announced a major capital raising. Australian Strategic Materials Ltd (ASX: ASM) hasn’t revealed what it is raising the money for, but it could be to fund its Dubbo Project in New South Wales. The company has previously stated its ambition to develop the Dubbo Project to supply globally significant quantities of zirconium and rare earth materials.

|

Quelle: https://www.fool.com.au/2021/03/24/w...umbling-lower/

++++++++++++++++++++++++++++++

Kurs-Zahlen + Chart in AUD: https://www.fool.com.au/tickers/asx-lyc/

++++++++++++++++++++++++++++++

Is the “rollercoaster over” for Lynas Rare Earths (ASX:LYC)?

Kerry Sun | March 11, 2021 9:50am |

https://www.fool.com.au/2021/03/11/i...earths-asxlyc/

Zitat:

Lynas Rare Earths 2025 growth vision

Lynas has its sights set on improving its operational delivery and ramping up production in the near term. The company successfully completed a ~$425 million capital raising back in August 2020 to support a number of initiatives.

The company’s flagship site, Mt Weld, is a tier 1 rare earths deposit. Proceeds from the capital raising will be used to complete the construction of a new rare earths processing facility next door in Kalgoorlie, Western Australia. The facility will be used to process rare earth concentrate from Mt Weld to produce mixed rare earth carbonate that will undergo further processing at the Lynas Malaysia Plant. Lynas is targeting the new site to be operational by July 2023.

Lynas has also partnered with the United States Government to build a light rare earths plant and undertake detail work for a heavy rare earth separation facility. Once operational, the plant is expected to produce approximately 5,000 tones of rare earths products per annum, including approximately 1,250 tonnes per annum of NdPr. The NdPr material will be directly sourced from the company’s new plant in Kalgoorlie.

|

+++++++++++++++++++++++++++++++++++++++

Rare earths market draws a crowd as new Lynas rivals gear up

Colin Kruger

By Colin Kruger, March 5, 2021, https://www.smh.com.au/business/comp...03-p577bt.html

Zitat:

Lynas shares soared above $6 last week when chief executive Amanda Lacaze presented better-than-expected results to investors, with a net profit of $40.6 million, up from $3.9 million in the prior first half.

Now, the threat emerging for Lynas is a novel one: Competition.

Lynas’ soaring share price reflects the optimism that the rare earths market is finally ready for prime time, and other local companies are following in its footsteps.

|

Zitat:

She {chief executive Amanda Lacaze} also had a clear message on rare earth prices, which have soared and dived over the years in speculative bursts: The rollercoaster is over.

The underlying macro-economic fundamentals of rising electric vehicles demand, green energy solutions such as wind power, consumer electronics and automation were starting to underpin the favourable prices the company is getting for these ores, Lacaze said and made it clear that no one is better placed than Lynas to capitalise on this.

|

Zitat:

|

“Rare earths are an excellent investment opportunity for exposure to the global megatrends that will shape our economies and our behaviours over the next decade,” she said. “And Lynas, amongst all the opportunities, is uniquely positioned to respond to those megatrends.”

|

Zitat:

New rivals

Perth-based ASX-listed Hastings Technology Metals is raising $100 million from investors as part of its $450 million rare earths processing plants in Western Australia.

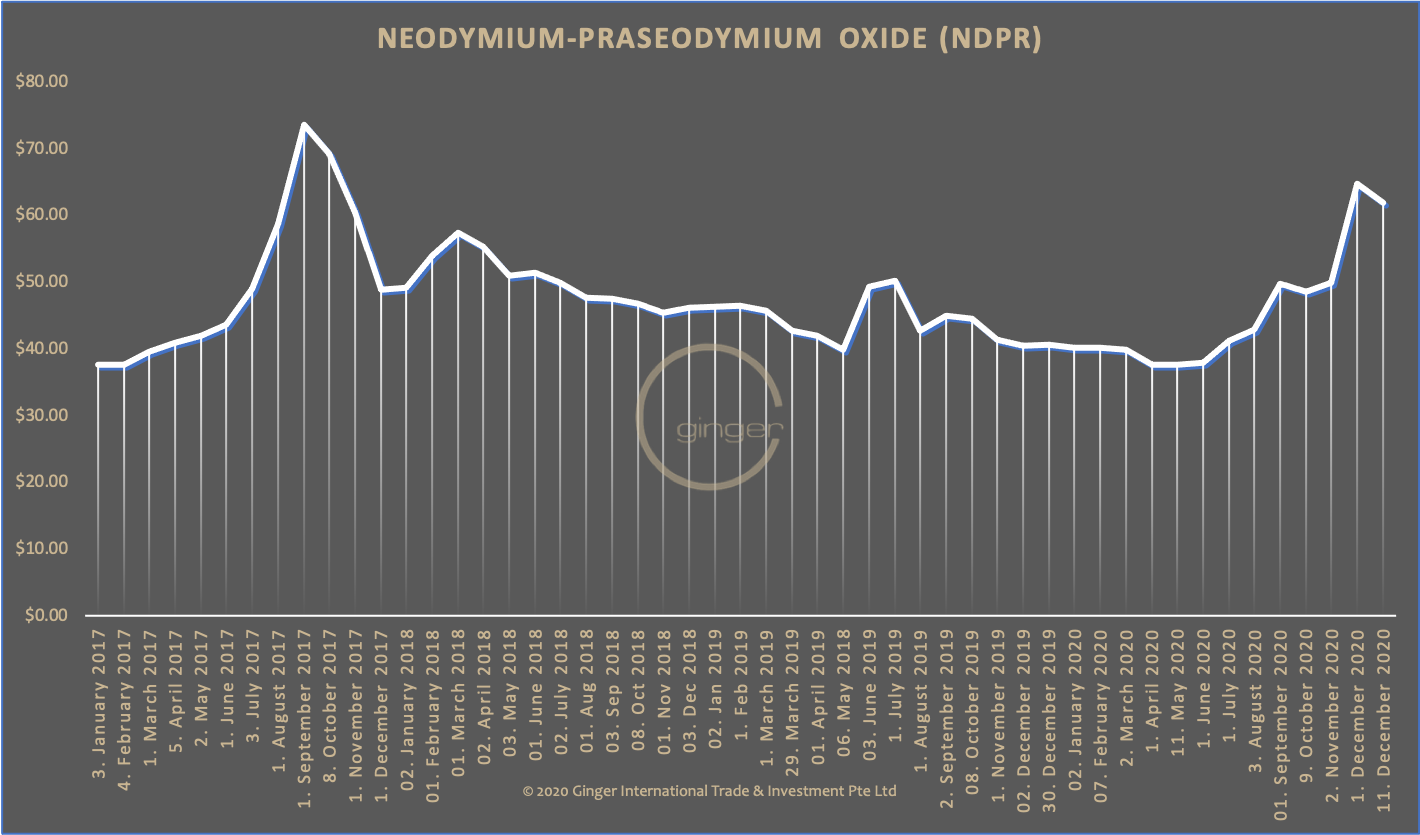

Hastings was happy to refer its investors to the recent Lynas results showing prices for NdPr had reached $US55,000 a tonne two months ago – “further highlighting the swift re-rating of the NdPr sector,” it said. The company also reported that the price of NdPr oxide has soared from about $US70,000 a tonne a month ago to almost $US86,000 now.

Long-time Lynas watcher Dylan Kelly from Ord Minnett nearly doubled Hasting’s share price target to 30 cents, and gave it a speculative buy recommendation.

“The rare earths thematic is firing and Hasting’s strategic position warrants a rerate,” he said.

Iluka Resources has also beefed up plans to invest more than $1 billion to replicate Lynas’s miner/processor operations, all within Australia. Goldman Sachs rated Iluka a buy based on its “compelling mineral sands and rare earths potential” which currently consists of a feasibility study to be completed in 12 months.

|

Zitat:

Ord Minnett’s Kelly downgraded Lynas from a buy recommendation to “lighten” after the stock more than doubled since July last year, citing concerns that current NdPr prices are unsustainable in the near term.

“Whilst an important value driver for Lynas earnings, NdPr prices are typically unreliable as they represent a small (40,000 tonnes per annum), and opaque Chinese domestic market,” Kelly said.

|

Zitat:

Not even Lacaze {chief executive Amanda Lacaze} is getting carried away with the current share price.

“We don’t get drunk on the price,” she told analysts and investors last week.

“We don’t participate in forecasting what’s going to happen with price. What we do do is source as much market intelligence as we can on whether the price changes have a foundation in actual behaviour, or whether they are speculative. And certainly, at this time, we continue to see strong demand.”

|

Geändert von Benjamin (24-03-2021 um 12:01 Uhr)

|

|

|

24-03-2021, 12:05

24-03-2021, 12:05

|

#4

|

|

TBB Family

Registriert seit: Mar 2004

Beiträge: 10.373

|

|

|

|

24-03-2021, 12:18

24-03-2021, 12:18

|

#5

|

|

TBB Family

Registriert seit: Mar 2004

Beiträge: 10.373

|

Top 14 UBS battery metals forecasts after VW teardown

zitiert aus Quelle https://www.nxtmine.com/top-14-ubs-b...-teardown/?amp

__________________

Beste Grüße, Benjamin

Geändert von Benjamin (24-03-2021 um 12:31 Uhr)

|

|

|

Forumregeln

Forumregeln

|

Es ist Ihnen nicht erlaubt, neue Themen zu verfassen.

Es ist Ihnen nicht erlaubt, auf Beiträge zu antworten.

Es ist Ihnen nicht erlaubt, Anhänge hochzuladen.

Es ist Ihnen nicht erlaubt, Ihre Beiträge zu bearbeiten.

HTML-Code ist aus.

|

|

|

Es ist jetzt 18:50 Uhr.

|